US President Donald Trump has issued a strong warning to anyone trading with Iran, following his re-imposition of sanctions on the country.

“Anyone doing business with Iran will NOT be doing business with the United States,” the president tweeted.

Some re-imposed sanctions took effect overnight and tougher ones relating to oil exports will begin in November.

Iran’s president said the measures were “psychological warfare” which aimed to “sow division among Iranians”.

- Iran nuclear deal: Key details

- The impact of Iran sanctions – in charts

- Firms face legal risk over Iran sanctions

The sanctions follow the US withdrawal from the Joint Comprehensive Plan of Action, also known as the Iran nuclear deal, earlier this year.

The deal, negotiated during the presidency of Barack Obama, saw Iran limit its controversial nuclear activities in exchange for sanctions relief.

Mr Trump has called the deal “one-sided”, “disastrous” and the “worst I’ve ever seen”. He believes renewed economic pressure will force Iran to agree to a new deal.

The European Union, which remains committed to the original agreement, has spoken out against the sanctions, vowing to protect firms doing “legitimate business” with Iran.

What else did Mr Trump say in his latest tweet?

He praised the “most biting sanctions ever imposed” and said they would “ratchet up to another level” in November.

“I am asking for WORLD PEACE, nothing less!” he said.

On Monday he had said that Iran faced a choice to “either change its threatening, destabilising behaviour and reintegrate with the global economy, or continue down a path of economic isolation”.

“I remain open to reaching a more comprehensive deal that addresses the full range of the regime’s malign activities, including its ballistic missile programme and its support for terrorism,” he said.

What are the sanctions?

Mr Trump signed an executive order that brought sanctions back into place at 00:01 EDT (04:01 GMT) on Tuesday. They target:

- The purchase or acquisition of US banknotes by Iran’s government

- Iran’s trade in gold and other precious metals

- Graphite, aluminium, steel, coal and software used in industrial processes

- Transactions related to the Iranian rial currency

- Activities relating to Iran’s issuance of sovereign debt

- Iran’s automotive sector

A second phase is planned to come back into effect on 5 November which will have implications for Iran’s energy and shipping sectors, petroleum trading and transactions by foreign financial institutions with the Central Bank of Iran.

What has the reaction been?

Iranian President Hassan Rouhani said the US government had “turned their back on diplomacy”.

What is the Iran nuclear deal?

“They want to launch psychological warfare against the Iranian nation.” he said. “Negotiations with sanctions doesn’t make sense. We are always in favour of diplomacy and talks… but talks need honesty.”

The foreign ministers of Germany, the UK and France released a statement on Monday that said the nuclear deal remained “crucial” to global security.

They also unveiled a “blocking statute”, which is intended to protect European firms doing business with Iran despite the new US sanctions.

Alistair Burt, the UK’s minister of state for the Middle East, told the BBC: “If a company fears legal action taken against it and enforcement action taken against it by an entity in response to American sanctions, then that company can be protected as far as EU legislation is concerned.”

He said Iran would simply “batten down the hatches” until the next US election.

However, German car and lorry maker Daimler, which announced a joint venture in Iran last year, confirmed this week that it has now ceased activities in the country.

How will Iran’s economy be affected?

Iran has already seen unrest since last December over a poorly-performing economy.

Rising food prices, unemployment and even poor water supplies have led to protests in a number of cities.

Demonstrations in Tehran in June were said to be the capital’s biggest since 2012.

How much they are tied to the new US sanctions policy is hard to determine, but one definite link is the effect on Iran’s currency. It lost around half of its value after Mr Trump announced the US withdrawal from the nuclear deal.

Iran acted by easing its foreign exchange rules on Sunday, and the rial has strengthened by 20% since then.

Iranians have been hoarding gold as a safeguard, pushing it to a record high in Tehran.

The sanctions may bite hardest in November, when the US blocks Iranian oil sales.

This could halt about half of Iran’s exports of some two million barrels a day, although Iran may look to China and Russia to keep its industry afloat.

The International Monetary Fund said in March that Iran’s net official reserves could decline this year to $97.8bn, which would finance about 13 months of imports. And analysts at BMI Research say Iran’s economy could contract by 4.3% in 2019.

However, Barbara Slavin, of the Future of Iran Initiative at the Atlantic Council, told the Wall Street Journal that when sanctions hit hard, it often means ordinary people become “totally dependent” on their government and so sanctions do not tend to topple regimes.

What do young Iranians think?

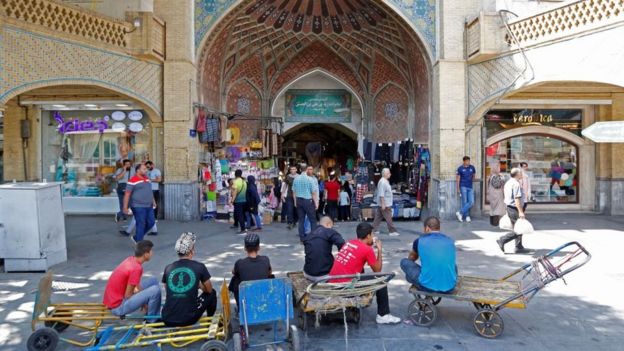

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGESAs the first tranche of new US sanctions kicks in, young Iranians have been sharing their stories with BBC Persian. Many are already feeling the effects, as the economy had slowed down in anticipation of what was to come.

“I used to work in marketing for a home appliance manufacturer,” said Peyman. “I lost my job as the company can’t import the components.”

Aerospace engineer Ali lost his job of 13 years because his company couldn’t import equipment.

“Now I’m working as a taxi driver to feed my family,” he said. Many people say they’re no longer being paid on time and are finding it hard to make ends meet.

A construction worker, also called Ali, said he hadn’t been paid for 13 months. Omid, a doctor, was doing overtime to pay the rent and save up to get married.

Many people said they were losing hope. Sama said falling exchange rates meant her monthly salary was now worth half what it was six months ago.

“Buying a house or a nice car is like a dream now, she said. “Even buying a good mobile phone soon will be impossible for people like me.”